|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

The Best Home Refinance Options: Unlocking Savings and BenefitsRefinancing your home can be a strategic move to lower your monthly payments, reduce your interest rate, or even tap into your home's equity. In this article, we'll explore the best home refinance options to help you make informed decisions. Why Consider Home Refinancing?Home refinancing offers several advantages that can improve your financial situation.

For those residing in Missouri, exploring st louis mortgage refinance options could yield significant savings. Types of Home Refinance LoansRate and Term RefinanceThis type of refinance allows you to change your loan's interest rate or term without altering the loan balance. Cash-Out RefinanceWith cash-out refinancing, you can borrow more than you owe on your home and receive the difference in cash, which can be used for various purposes. Streamline RefinanceGovernment-backed loans like FHA, VA, and USDA offer streamline refinancing options that require less documentation and underwriting. Steps to Refinancing Your Home

When comparing rates, it's beneficial to consider st louis refinance mortgage rates to ensure you get the best deal available. FAQWhat is the best time to refinance a home?The best time to refinance is when interest rates are low, and you can save significantly on your monthly payments. How does refinancing affect my credit score?Refinancing may temporarily lower your credit score due to a hard inquiry, but paying off the loan consistently can improve it over time. Can I refinance with bad credit?While challenging, it is possible to refinance with bad credit, especially through government-backed loans or by improving your credit score beforehand. In conclusion, refinancing your home can be a powerful tool to enhance your financial stability and achieve your economic goals. By understanding your options and following the steps outlined, you can find the best home refinance solution for your needs. https://www.cbsnews.com/news/how-to-get-best-mortgage-refinance-rates-according-to-experts/

If you're interested in a mortgage refinance loan, you can better position yourself to get the best interest rates by taking the following steps. https://www.reddit.com/r/Mortgages/comments/1fo4n2l/whats_the_best_refinance_options/

Hi folks, I got the 800k loan last Nov/2024 and been living in my house for almost a year. Now the rate dropped 2BPs so it's my first time ... https://www.lendingtree.com/home/refinance/

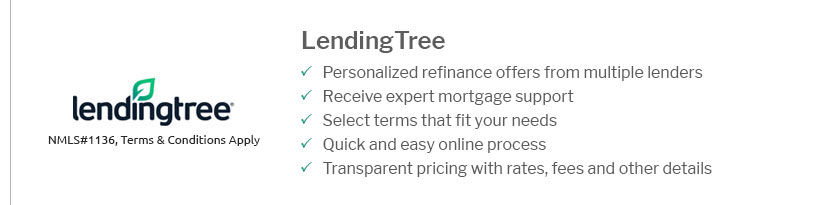

Best refinance lender overall: Rate - Best online mortgage refinance experience from a traditional bank: Chase - Best for online refinance rate transparency: ...

|

|---|